Copilot App Review: Your Personalized Financial Companion

Copilot stands out as an exceptional financial management solution designed to empower users to monitor their financial accounts. Boasting a user-friendly interface and adaptable customization features, Copilot proves to be a remarkable application for taking charge of your financial affairs and enhancing your overall financial planning. That said, let’s take a look at its capabilities through this Copilot app review.

What is Copilot?

Copilot serves as an advanced financial management tool crafted to assist you in monitoring not just your accounts, subscriptions, bills, and net worth but also connecting with your investment portfolios. The meticulously designed interface ensures effortless money management, offering clarity on your financial inflows and outflows.

Moreover, Copilot goes beyond mere tracking by sending timely notifications when you receive payments. This feature-packed app proves invaluable in taking command of your financial resources and elevating the effectiveness of your overall financial planning.

Is Copilot safe?

When you start exploring the app, one of the initial concerns you might have is about its security. After all, you’re granting it access to read your financial data. The thought of potential exposure can be unsettling.

Luckily, with Copilot, your data is safeguarded using robust security measures. They employ 256-bit encryption to secure your data at rest and rely on Transport Layer Security (TLS) to protect it in transit. Importantly, Copilot doesn’t store your bank login details. Instead, they collaborate with trusted data aggregators like Plaid and Finicity, acting as intermediaries to ensure a secure barrier between your information and the app. Your data’s privacy and security are top priorities with Copilot.

Key Features

Packed with an array of practical features, Copilot becomes your ally in money management, aiding you in overseeing your finances, tracing expenditure patterns, and comprehending your long-term financial trends. Our Copilot review will guide you through its primary features and delve into what many people find particularly appealing (and perhaps not so much) about it.

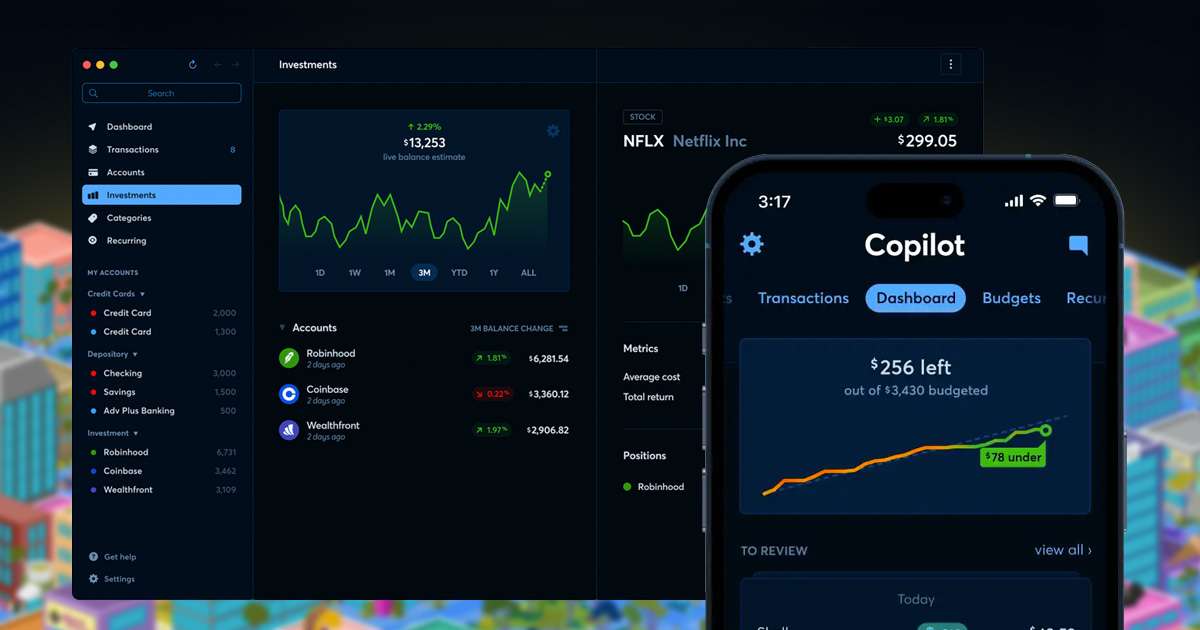

Account Management

Experience the convenience of a clear and concise graph that allows you to monitor all the accounts you choose on a single page. Whether it’s your checking, savings, credit cards, investment portfolios, loans, or even crypto wallets, they’re all there!

In the event that the platform doesn’t currently support automatic tracking for one of your financial accounts, fear not. You have the flexibility to add it manually.

Explore the page where your assets and debts come to life in dynamic graphs, spanning from the past week to a year ago. And here’s a neat feature: if you prefer not to see your debt, simply hide it!

Investment Overview

If you’re deeply immersed in the world of investments, this page is tailor-made. Effortlessly monitor the highs of your investment earnings or the lows of disappointing losses—all conveniently laid out on a single page.

Choose your preferred timeline, whether it’s the past week or a whole year, and witness the fluctuations in your investment journey. Enhance your financial panorama by seamlessly incorporating the IRA, stock, and other investment accounts onto this page, providing you with a comprehensive snapshot of your overall net worth.

Transaction List

Delve into your financial history on the transaction page, where you can effortlessly browse through years of transactions all in one comprehensive view. As you meticulously categorize each transaction into your budgeting categories, you’ll witness the magic of having your entire financial landscape neatly populated on a single page.

For those moments when time has passed and you need to track down specific transactions, a quick search feature is at your disposal. Plus, for those external or cash transactions, you can manually add them, ensuring no detail goes unnoticed. Refine your transaction exploration by filtering based on date, price, category, and even account, providing you with a nuanced perspective on your spending trends.

Copilot Finance takes the complexity out of financial management, offering personalized insights and seamless organization of your transactions, making it a breeze for you to comprehend and manage your finances effectively.

Budgeting and Categories

Take charge of your financial game with Copilot’s personalized budgeting feature, designed to align seamlessly with your distinct spending habits. Revel in the convenience of automatic detection for recurring bills and subscriptions.

Budget rollovers add an extra layer of ease to your financial tracking across multiple months, ensuring you stay ahead and avoid unexpected expenses. If you’re not someone who traditionally budgets, no worries; Copilot is flexible. Tailor it to your liking, make adjustments on the fly, or simply add transactions without the constraints of a budget if that suits your style.

Your financial autonomy is paramount with Copilot’s customizable budgeting features:

- Shape your budget categories to match your lifestyle

- Establish bespoke rules for categorizing transactions

- Roll over surplus budgets on a per-category basis from one month to the next

- Set up variable budget categories tailored for different months

- Quickly tweak and balance your budget categories as the need arises. Copilot puts the power in your hands

- for effortless and tailored financial management.

Dashboard

Once you’ve fine-tuned all these pages to align with your unique spending and budgeting preferences, take a glance at the dashboard for a comprehensive overview—it’s personally my favorite and the one I find myself checking most frequently.

On the dashboard, a graph and budget line await, reflecting your set target spending rate for the month. Witness how closely you’re tracking your budget, discerning whether you’re surpassing or falling short, and pinpointing exactly when in the month you exceeded expectations. The dashboard offers a dynamic and insightful snapshot of your financial journey, making it a go-to resource for keeping tabs on your progress.

Graphs

All the features we’ve covered are showcased through aesthetically pleasing graphs on every page of the app. I mean, who wouldn’t want an app with visually appealing graphs, right?

Setting jokes aside, these interactive graphs play a crucial role in swiftly and effortlessly comprehending your holistic financial picture. Tailor the date range to your preference, and consider adding indicators like net worth, cash flow, savings rate, and more for a truly personalized experience. The beauty of these graphs isn’t just in their appearance but in the insights they provide to help you gain a quick and meaningful understanding of your financial landscape.

Discover More About the Copilot App with Our Comprehensive Review

Copilot can empower you to monitor and enhance your financial affairs. From its user-friendly interface to advanced security measures, Copilot ensures your data’s privacy is a top priority. Seamlessly connect with your investment portfolios, track transactions, and revel in the convenience of personalized budgeting features.

The comprehensive dashboard provides a dynamic snapshot of your financial progress, while aesthetically pleasing graphs offer insightful perspectives. Take control of your financial destiny with Copilot – a sophisticated app designed for those who aspire to understand, manage, and optimize their finances effortlessly.